Introduction

Hey readers,

Estate law can be a complex and daunting process, especially when you’re grieving the loss of a loved one. In Windsor, Ontario, there are many experienced attorneys who can assist you with your estate needs. This comprehensive guide will provide you with all the information you need to find the best attorney for your specific situation.

Finding an Estate Attorney in Windsor

Credentials and Experience

When choosing an estate attorney, it’s important to consider their credentials and experience. Look for an attorney who has a strong track record in estate planning and administration. They should be up-to-date on the latest tax laws and estate planning techniques.

Communication and Trust

It’s also essential to find an attorney who you can communicate with easily. You’ll be sharing very personal information with your attorney, so it’s critical that you trust them implicitly. Interview a few attorneys before choosing one to ensure that you feel comfortable working with them.

Estate Planning Services

Wills and Trusts

A will is a legally binding document that outlines how your assets will be distributed after your death. A trust is a legal entity that can be used to hold assets for the benefit of another person. Both wills and trusts can be used to avoid probate, which is the court-supervised process of distributing an estate.

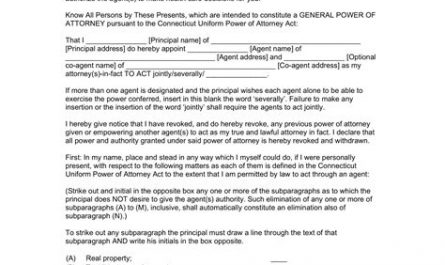

Powers of Attorney

A power of attorney is a legal document that allows you to appoint someone else to act on your behalf in financial or medical matters. This can be helpful if you become incapacitated and unable to manage your own affairs.

Estate Administration

If you are the executor of an estate, you will need to work with an attorney to administer the estate. This involves gathering the deceased person’s assets, paying their debts, and distributing their property to their beneficiaries.

Probate and Estate Litigation

Probate

Probate is the court-supervised process of distributing an estate. An attorney can help you file a petition for probate and navigate the probate process.

Estate Litigation

Estate litigation can arise when there are disputes over the distribution of an estate. An attorney can represent you in estate litigation and protect your interests.

Legal Fees

The legal fees for estate planning services vary depending on the complexity of your estate and the attorney’s experience. It’s important to get a clear understanding of the fees involved before you hire an attorney.

Table: Estate Planning Fees

| Service | Average Fee |

|---|---|

| Simple Will | $300 – $500 |

| Complex Will | $500 – $1,000 |

| Revocable Living Trust | $1,000 – $2,000 |

| Irrevocable Living Trust | $2,000 – $5,000 |

| Power of Attorney | $100 – $200 |

| Probate | 3-5% of the estate’s value |

Conclusion

Estate planning is a critical step in protecting your loved ones and your assets. By finding an experienced attorney in Windsor, Ontario, you can ensure that your estate is handled according to your wishes.

If you found this guide helpful, be sure to check out our other articles on estate planning and related topics:

- Estate Planning for Seniors: A Step-by-Step Guide

- What to Do If You’re Named the Executor of an Estate

- 5 Mistakes to Avoid When Creating Your Will

FAQ about Attorney Windsor Ontario Estate Law

What is estate law?

Estate law involves managing the administration of a person’s assets after their death, including their will, estate planning, and probate.

What is a will?

A will is a legal document that outlines a person’s wishes for the distribution of their assets after their death.

Do I need a will?

Everyone should have a will, regardless of their age or assets, to ensure their wishes are carried out and to avoid probate disputes.

What is probate?

Probate is the legal process of administering a person’s estate after their death, including paying debts, distributing assets, and finalizing the estate.

What is an estate lawyer?

An estate lawyer specializes in estate law and can provide guidance on estate planning, will drafting, and probate matters.

How do I choose an estate lawyer?

Consider the lawyer’s experience, reputation, and fees when selecting an estate lawyer.

What is estate planning?

Estate planning involves making arrangements to manage and distribute your assets after your death, such as creating a will, setting up a trust, or appointing a power of attorney.

What are the benefits of estate planning?

Estate planning allows you to control the distribution of your assets, minimize taxes, and avoid disputes among beneficiaries.

What is a trust?

A trust is a legal arrangement where a person (the settlor) transfers assets to a trustee to hold and manage for the benefit of another person (the beneficiary).

What is power of attorney?

A power of attorney is a legal document that authorizes another person to act on your behalf, including managing your finances and making decisions about your healthcare.