Navigating the complexities of bankruptcy can feel overwhelming, especially in a bustling city like Houston. Understanding your options, choosing the right legal representation, and successfully completing the bankruptcy process requires careful planning and expert guidance. This guide explores the intricacies of Houston bankruptcy law, providing valuable insights into the various chapters of bankruptcy, the process itself, and the crucial role of a skilled bankruptcy attorney.

From eligibility requirements and common misconceptions to post-bankruptcy considerations and credit rebuilding strategies, we aim to demystify the process and empower you with the knowledge needed to make informed decisions. We’ll delve into the specifics of Chapter 7, Chapter 11, and Chapter 13 bankruptcies, highlighting the differences and suitability for various circumstances. We’ll also address the critical aspects of finding a qualified attorney, including factors to consider when making your selection.

Understanding Houston Bankruptcy Law

Navigating the complexities of bankruptcy can be daunting, particularly in a large metropolitan area like Houston. This section provides a foundational understanding of Texas bankruptcy law, focusing on the different chapters available and their respective eligibility requirements. Understanding these aspects is crucial for individuals and businesses facing financial hardship.

Texas Bankruptcy Chapters

Texas, like all other states, follows the federal bankruptcy code. However, state laws can influence certain aspects of the process. The most common chapters utilized are Chapter 7, Chapter 11, and Chapter 13. Each chapter offers a different approach to debt resolution, tailored to specific circumstances.

Chapter 7 Bankruptcy Eligibility

Chapter 7, often referred to as liquidation bankruptcy, is available to both individuals and businesses. Eligibility hinges on meeting certain income and asset requirements. Specifically, individuals must pass a means test, comparing their income to the median income in their state. If their income is below a certain threshold, they generally qualify. Businesses, on the other hand, don’t have a similar income-based test but must demonstrate insolvency. Further, significant assets may be subject to liquidation to pay off creditors.

Chapter 11 Bankruptcy Eligibility

Chapter 11 bankruptcy, often used by businesses, allows for reorganization rather than liquidation. Eligibility is less restrictive than Chapter 7. Generally, any business, regardless of size or profitability, can file for Chapter 11. Individuals may also file under Chapter 11, though it’s less common due to the complexities and costs involved. The process involves creating a reorganization plan to repay creditors over time.

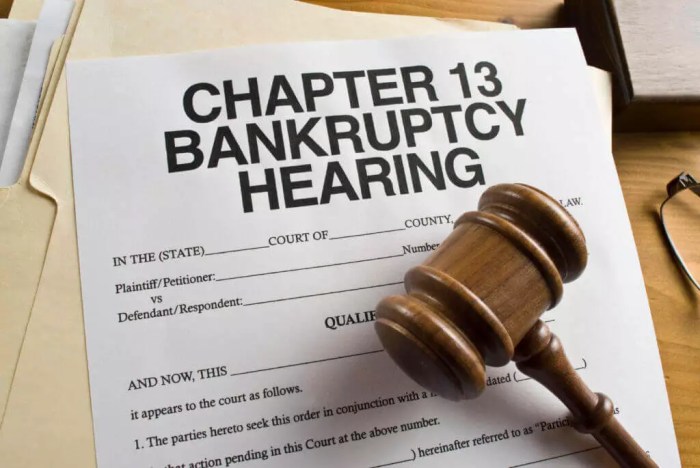

Chapter 13 Bankruptcy Eligibility

Chapter 13, a reorganization chapter for individuals, provides a structured repayment plan over three to five years. Eligibility requires that the debtor has regular income and secured debts (like a mortgage or car loan) that are less than a certain amount. This chapter allows individuals to keep their assets while paying off debts according to a court-approved plan. Unsecured debts, such as credit card debt, are often included in the repayment plan.

Comparison of Chapter 7, Chapter 11, and Chapter 13

| Feature | Chapter 7 | Chapter 11 | Chapter 13 |

|---|---|---|---|

| Type | Liquidation | Reorganization | Reorganization |

| Debtor Type | Individuals & Businesses | Individuals & Businesses | Individuals |

| Asset Liquidation | Usually required | Not usually required | Not usually required |

| Repayment Plan | None | Required | Required |

| Typical Duration | Relatively short | Varies greatly | 3-5 years |

Common Misconceptions about Houston Bankruptcy

Many misconceptions surround bankruptcy. One common belief is that it destroys credit forever. While bankruptcy does negatively impact credit scores, it doesn’t ruin credit permanently. Scores gradually improve over time with responsible financial behavior after the bankruptcy is discharged. Another misconception is that only those with massive debts can file. Individuals with relatively modest debts can also benefit from bankruptcy if they meet the eligibility criteria. Finally, some believe that all assets are seized. In reality, many assets, particularly those considered essential for daily living, are often protected by exemptions under state and federal law.

Bankruptcy Process Flowchart in Texas

A flowchart would visually represent the stages: Filing the petition, creditor notification, meeting of creditors (341 meeting), development of a repayment plan (if applicable), confirmation of the plan by the court, and finally, discharge or completion of the plan. The flowchart would depict a branching path for Chapter 7 (liquidation) versus Chapter 13 (reorganization), highlighting the differences in procedures. For example, a Chapter 7 branch would show asset evaluation and potential liquidation, while a Chapter 13 branch would show the creation and court approval of a repayment plan. The process for Chapter 11 would be more complex, showing negotiation with creditors and court approval of a reorganization plan.

Finding the Right Attorney

Choosing the right bankruptcy attorney in Houston is crucial for navigating the complexities of bankruptcy law and achieving the best possible outcome. A skilled and experienced attorney can make a significant difference in your case, guiding you through the process, protecting your rights, and helping you secure a fresh financial start. Careful consideration of several key factors will help you make an informed decision.

Qualities to Seek in a Houston Bankruptcy Lawyer

Selecting a bankruptcy lawyer requires careful evaluation of their experience, expertise, and communication style. Look for an attorney with a proven track record in handling cases similar to yours, demonstrating a deep understanding of bankruptcy law, and possessing excellent communication skills to keep you informed throughout the process. Ideally, your attorney should be a member of the State Bar of Texas and possess a strong reputation within the Houston legal community. Consider attorneys who offer free initial consultations to allow you to assess their suitability before committing. A comfortable and trusting attorney-client relationship is paramount.

Fees and Pricing Structures of Bankruptcy Attorneys

Bankruptcy attorney fees vary depending on the complexity of the case, the attorney’s experience, and the type of bankruptcy filed (Chapter 7 or Chapter 13). Most attorneys charge an upfront retainer fee, followed by hourly rates or flat fees for specific services. Some may offer payment plans to accommodate clients’ financial situations. It’s essential to obtain a clear and detailed fee schedule upfront, outlining all costs involved, including court filing fees and other expenses. Comparing fees across several attorneys is advisable, ensuring that you are getting a fair price for the services rendered. Transparency regarding fees is a crucial indicator of a reputable attorney.

Resources for Finding Reputable Bankruptcy Lawyers in Houston

Several resources can assist in finding qualified bankruptcy attorneys in Houston. The State Bar of Texas website provides a lawyer referral service, allowing you to search for attorneys based on their area of practice and location. Online legal directories, such as Avvo and Justia, offer attorney profiles with client reviews and ratings. Professional organizations, like the Houston Bar Association, may also offer referral services or provide lists of member attorneys specializing in bankruptcy law. Word-of-mouth referrals from trusted sources, such as friends, family, or financial advisors, can also be valuable. Thorough research using multiple resources is highly recommended.

Attorney-Client Confidentiality in Bankruptcy Cases

Attorney-client confidentiality is paramount in bankruptcy cases. All communications between you and your attorney are protected by attorney-client privilege, meaning they cannot be disclosed to third parties without your consent. This privilege extends to all aspects of your case, including your financial information, personal details, and legal strategies. Choosing an attorney with a strong commitment to confidentiality is crucial to protecting your sensitive information and ensuring the privacy of your legal proceedings. A reputable attorney will clearly explain the limits and scope of this privilege.

Checklist of Questions to Ask Potential Bankruptcy Attorneys

Before engaging an attorney, prepare a list of questions to ensure you understand their approach and qualifications. Inquire about their experience handling cases similar to yours, their fee structure and payment options, their communication style and availability, their approach to client interaction, and their success rate in bankruptcy cases. Ask about their familiarity with the Houston bankruptcy courts and their strategy for resolving your specific situation. Clarify their process for managing your case and the timeline involved. Finally, inquire about client references or testimonials to gain insights into their past performance. A thorough questioning process empowers you to make a well-informed decision.

The Bankruptcy Process in Houston

Filing for bankruptcy in Houston, like elsewhere, involves a series of legal steps designed to protect both debtors and creditors. The process can seem daunting, but understanding the stages and the roles of involved parties can significantly alleviate stress and increase the chances of a successful outcome. This section details the process, the role of the trustee, asset protection, debt discharge, and provides a typical timeline.

Steps Involved in Filing for Bankruptcy in Houston

The initial step is choosing the appropriate chapter of bankruptcy – Chapter 7 (liquidation) or Chapter 13 (reorganization). This decision depends heavily on your financial situation and goals. After selecting the chapter, you’ll need to gather extensive financial documentation, including income statements, tax returns, asset lists, and debt schedules. This information forms the basis of your bankruptcy petition, which is then filed with the U.S. Bankruptcy Court for the Southern District of Texas. Following the filing, creditors are notified, and an initial meeting of creditors is scheduled with the bankruptcy trustee. Throughout the process, adhering to court deadlines and requirements is critical. Failure to do so can lead to delays or even dismissal of the case.

The Role of the Bankruptcy Trustee

The bankruptcy trustee is a court-appointed official who oversees the bankruptcy proceedings. In Chapter 7 cases, the trustee’s primary responsibility is to liquidate non-exempt assets to pay creditors. In Chapter 13 cases, the trustee monitors the debtor’s compliance with the repayment plan. The trustee investigates the debtor’s financial affairs to ensure honesty and compliance with bankruptcy laws. They review the debtor’s schedules and documents, and may even conduct interviews to verify the information provided. Their role is impartial, aiming to protect the interests of both the debtor and creditors. The trustee has the power to object to certain aspects of the bankruptcy case, such as the debtor’s exemptions or the proposed repayment plan.

Common Assets Protected in Bankruptcy

Many assets are protected under federal and state bankruptcy exemptions. These exemptions vary by state, and Texas offers specific protections. Common examples include a certain amount of equity in your primary residence (homestead exemption), a vehicle, personal property up to a specified value, and certain retirement accounts. The specific dollar amounts of these exemptions are subject to change and should be verified with current legal resources. For instance, a portion of your retirement savings might be protected, preventing creditors from seizing these funds. Similarly, a portion of your home equity is often protected under the Texas homestead exemption, ensuring you don’t lose your home to creditors. It is important to consult with a bankruptcy attorney to determine which assets are protected in your specific circumstances.

Discharging Debts in Bankruptcy

One of the primary goals of bankruptcy is to discharge, or eliminate, certain debts. Chapter 7 bankruptcy generally results in the discharge of most unsecured debts, such as credit card debt and medical bills. However, certain debts are non-dischargeable, including student loans (often), taxes, and debts incurred through fraud. Chapter 13 bankruptcy involves a repayment plan over three to five years, after which remaining debts may be discharged. The discharge of debts provides a fresh financial start, but it’s important to understand the implications and limitations of this process. Successfully completing the bankruptcy process according to the court’s requirements is essential for debt discharge.

Timeline of a Typical Bankruptcy Case

| Stage | Timeline | Actions | Outcome |

|---|---|---|---|

| Filing the Petition | Immediately | Prepare and file bankruptcy petition, schedules, and statements. | Case officially commenced. Automatic stay takes effect. |

| Creditors’ Meeting | Within 20-40 days of filing (Chapter 7); varies in Chapter 13 | Debtor attends meeting with creditors and trustee. | Trustee assesses assets and liabilities; creditors may question debtor. |

| Asset Liquidation (Chapter 7) or Plan Confirmation (Chapter 13) | Chapter 7: Varies, depending on asset liquidation. Chapter 13: Within several months. | Chapter 7: Trustee liquidates non-exempt assets. Chapter 13: Debtor proposes and court confirms repayment plan. | Chapter 7: Creditors receive payments from liquidated assets. Chapter 13: Debtor begins making payments according to the confirmed plan. |

| Discharge (Chapter 7) or Completion of Plan (Chapter 13) | Chapter 7: Typically 3-6 months after filing. Chapter 13: 3-5 years after plan confirmation. | Court grants discharge (Chapter 7) or plan is completed (Chapter 13). | Most dischargeable debts are eliminated (Chapter 7) or plan is successfully completed (Chapter 13). |

Specific Issues in Houston Bankruptcy Cases

Navigating bankruptcy in Houston requires understanding the interplay between federal bankruptcy law and specific Texas state laws. The unique economic landscape of Houston, with its significant energy and real estate sectors, also influences the types of bankruptcy cases filed and the challenges faced by debtors and creditors.

Texas State Laws and Bankruptcy Proceedings

Texas state laws impact bankruptcy proceedings in several key areas. For example, Texas’ homestead exemption laws protect a certain amount of equity in a debtor’s primary residence from creditors. The specific amount of this exemption can vary depending on factors like the debtor’s family size and location. Additionally, Texas has specific laws regarding property division in divorce cases, which can significantly impact bankruptcy proceedings if a divorce is pending or has recently concluded. These state laws often interact with federal bankruptcy exemptions, creating complexities that require careful consideration by bankruptcy attorneys. For instance, a debtor may be able to claim a larger homestead exemption under state law than under federal law, offering more protection in bankruptcy.

Real Estate and Property in Houston Bankruptcy Cases

Houston’s robust real estate market presents unique challenges in bankruptcy. The value of real property can fluctuate significantly, impacting the debtor’s ability to repay creditors. Bankruptcy proceedings often involve the appraisal and potential sale of real estate to satisfy creditors’ claims. The process of determining the fair market value of property can be complex and potentially lead to disputes between debtors and creditors. Moreover, the process of liquidating real estate can be time-consuming, adding to the overall duration of the bankruptcy case. For example, a debtor might own a commercial property in a rapidly developing area, and determining its fair market value accurately requires expert appraisal that takes into account future development potential.

Business Bankruptcies in Houston

Houston’s diverse economy, particularly its dependence on the energy sector, makes it susceptible to economic downturns that can trigger business bankruptcies. These cases often involve complex issues such as the valuation of business assets, the treatment of secured and unsecured creditors, and the potential sale or reorganization of the business. Business bankruptcies in Houston frequently involve multiple creditors, requiring careful negotiation and strategic planning to achieve the best possible outcome for all parties involved. For instance, an oil and gas company facing bankruptcy might have significant debt secured by its drilling equipment and leases, requiring complex negotiations with secured creditors to prevent liquidation.

Common Legal Challenges in Houston Bankruptcy Cases

Individuals and businesses in Houston frequently face various legal challenges during bankruptcy proceedings. These include disputes over asset valuation, challenges to creditor claims, and issues related to exemptions. Debtors may face challenges proving eligibility for certain exemptions or demonstrating the accuracy of their financial statements. Creditors may challenge the debtor’s claimed exemptions or attempt to recover assets they believe are not properly exempted. For example, a debtor might claim a higher than usual homestead exemption based on a specific interpretation of Texas law, leading to a dispute with creditors.

Common Reasons for Bankruptcy Filings in Houston

Understanding the reasons behind bankruptcy filings provides insight into the challenges faced by individuals and businesses in the Houston area.

- Medical debt: High medical expenses, often uninsured or underinsured, can overwhelm household budgets.

- Job loss: Economic downturns or industry-specific layoffs can lead to sudden income loss and inability to meet financial obligations.

- Business failures: Economic fluctuations and competition can lead to business closures and subsequent bankruptcy filings.

- High-interest debt: Credit card debt and payday loans, with their high-interest rates, can quickly become unmanageable.

- Divorce: The financial ramifications of divorce, including property division and support payments, can trigger bankruptcy.

Post-Bankruptcy Considerations

Bankruptcy can significantly impact your financial life, but it doesn’t have to be a permanent setback. Understanding the long-term consequences and employing effective strategies for rebuilding your credit and finances is crucial for a successful financial recovery. This section details the effects of bankruptcy on your credit, Artikels strategies for rebuilding your credit, and provides guidance on managing your finances post-discharge.

Impact of Bankruptcy on Credit Scores

Bankruptcy significantly lowers your credit score. The impact varies depending on the type of bankruptcy (Chapter 7 or Chapter 13) and your credit history before filing. A Chapter 7 bankruptcy typically remains on your credit report for 10 years, while a Chapter 13 bankruptcy remains for 7 years if successfully completed. During this period, your credit score will be considerably lower than it was before the bankruptcy. The severity of the score reduction depends on several factors including the length of your credit history and the presence of other negative marks on your report. For example, someone with a long history of responsible credit use might see a less drastic drop than someone with a shorter history and existing negative marks. It’s important to remember that this is not a permanent situation, and scores can be improved over time with diligent effort.

Strategies for Rebuilding Credit After Bankruptcy

Rebuilding credit after bankruptcy requires patience and consistent effort. One effective strategy is to obtain a secured credit card. These cards require a security deposit, which limits your credit limit and reduces the lender’s risk. Responsible use of a secured card demonstrates your ability to manage credit, gradually improving your credit score. Another approach is to become an authorized user on a credit card of someone with good credit. This allows you to benefit from their positive credit history, though it’s crucial to ensure the primary cardholder maintains responsible spending habits. Building a positive payment history on utility bills and rent, even though these aren’t traditionally reported to credit bureaus, can be helpful, as some companies now offer services to report this data. Finally, consistently monitoring your credit report for errors and ensuring all information is accurate is essential. Regularly checking your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) is recommended.

Long-Term Financial Implications of Bankruptcy

The long-term financial implications of bankruptcy extend beyond credit scores. Securing loans, such as mortgages or auto loans, can be more challenging and often come with higher interest rates for several years following a bankruptcy discharge. It may also impact your ability to rent an apartment or secure certain types of employment, particularly those requiring high levels of financial responsibility or trust. However, with careful financial planning and responsible credit management, these limitations can be overcome over time. For example, someone seeking a mortgage after bankruptcy might need a larger down payment or might have to wait longer before they qualify.

Legal Restrictions on Obtaining Credit After Bankruptcy

While bankruptcy doesn’t permanently bar you from obtaining credit, it can make it more difficult in the short term. Lenders will scrutinize your credit report more carefully, and you might face higher interest rates and stricter lending terms. Some lenders might be unwilling to extend credit altogether for a period of time following the discharge. Understanding these restrictions and proactively working to improve your creditworthiness is key to navigating this phase. For example, a person applying for a car loan after bankruptcy might be offered a loan with a higher interest rate than someone with a strong credit history. They may also be required to make a larger down payment.

Step-by-Step Guide for Managing Finances After Bankruptcy Discharge

Effectively managing finances post-bankruptcy involves a structured approach.

- Create a Realistic Budget: Track your income and expenses meticulously to identify areas for improvement and savings.

- Pay Bills on Time: Consistent on-time payments are crucial for rebuilding credit. Set up automatic payments if necessary.

- Avoid New Debt: Refrain from accumulating additional debt until your credit score has improved significantly.

- Monitor Credit Report: Regularly review your credit report for accuracy and identify any potential issues.

- Seek Financial Counseling: Consider professional financial counseling to develop a long-term financial plan.

- Explore Credit Repair Services (Cautiously): Research credit repair services thoroughly, being aware of potential scams.

Following these steps diligently can pave the way for a more secure financial future. Remember, rebuilding credit takes time and consistent effort, but with the right approach, it’s achievable.

Illustrative Case Studies (No actual cases, hypothetical)

This section presents hypothetical case studies to illustrate the application of bankruptcy law in Houston. These examples are for educational purposes only and do not represent actual cases or legal advice. The details are simplified for clarity.

Chapter 11 Bankruptcy: Small Business Owner

This hypothetical case involves “Houston Hot Sauce,” a small food manufacturing business experiencing financial difficulties due to increased competition and rising ingredient costs. The owner, Maria, decides to file for Chapter 11 bankruptcy to reorganize her business and avoid liquidation. The Chapter 11 process allows Maria to continue operating her business while working with creditors to develop a reorganization plan. This plan might involve restructuring debt, selling some assets, or negotiating payment terms. The court oversees the process, ensuring fairness to all stakeholders. After several months of negotiations and court hearings, Maria successfully negotiates a plan that is approved by the creditors and the court. Houston Hot Sauce continues operations, albeit with a restructured debt load and a revised business model.

Chapter 7 Bankruptcy: Individual Filing

John, a Houston resident, faces overwhelming debt from medical bills and credit card debt after a job loss. He decides to file for Chapter 7 bankruptcy, seeking a fresh start. In Chapter 7, non-exempt assets are liquidated to pay off creditors. John’s exempt assets, including his primary residence (up to a certain equity limit), a vehicle, and essential personal property, are protected. Many of his debts, including credit card debt and medical bills, are discharged. The emotional impact on John is significant; he experiences stress, anxiety, and feelings of failure. However, the relief of knowing his debts are discharged eventually outweighs the initial emotional burden. He is able to rebuild his credit and financial life over time.

Comparison of Chapter 7 and Chapter 13 Bankruptcy Outcomes

The following table compares hypothetical outcomes and timelines for Chapter 7 and Chapter 13 bankruptcy filings in Houston. These are simplified examples and actual timelines and outcomes vary significantly based on individual circumstances and court procedures.

| Feature | Chapter 7 | Chapter 13 | Comparison Notes |

|---|---|---|---|

| Type of Relief | Liquidation of non-exempt assets; debt discharge | Reorganization of debts; repayment plan | Chapter 7 offers faster debt relief but may involve asset liquidation. Chapter 13 allows for debt management and retention of assets, but involves a longer repayment period. |

| Eligibility Requirements | Generally, lower income and debt levels | Generally, higher income and debt levels, ability to create a repayment plan | Eligibility is determined based on income, assets, and debts. Credit counseling is required for both. |

| Timeline | 3-6 months | 3-5 years (depending on repayment plan) | Chapter 7 is significantly faster. Chapter 13 requires consistent payments over a longer period. |

| Outcome | Debt discharge (except certain debts); potential loss of some assets | Gradual debt repayment; retention of assets; potential impact on credit score during repayment | Chapter 7 provides a quicker, clean slate, but with potential asset losses. Chapter 13 allows for debt management and asset retention but requires a longer commitment. |

Final Wrap-Up

Facing financial hardship can be incredibly stressful, but understanding your legal options and securing competent representation can significantly ease the burden. By carefully considering the information presented, individuals and businesses in Houston can navigate the bankruptcy process with greater confidence. Remember, seeking professional legal counsel is crucial; this guide serves as a valuable starting point, but it’s not a substitute for personalized advice from a qualified bankruptcy law attorney in Houston.

FAQ Insights

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 involves liquidation of non-exempt assets to pay off debts, while Chapter 13 allows for a repayment plan over three to five years.

How much does a bankruptcy attorney cost in Houston?

Fees vary widely depending on the attorney and the complexity of the case. It’s best to consult with several attorneys to compare fees and payment plans.

Can I keep my house in bankruptcy?

It depends on the type of bankruptcy and your specific circumstances. Texas has homestead exemptions that protect a certain amount of equity in your home.

How long does the bankruptcy process take?

The timeline varies depending on the chapter and the complexity of the case. Chapter 7 is generally faster than Chapter 13.

What happens to my credit score after bankruptcy?

Bankruptcy will negatively impact your credit score, but it will eventually improve over time with responsible financial management.